GROW YOUR CHANGE

Grow Your Change for Instant Savings

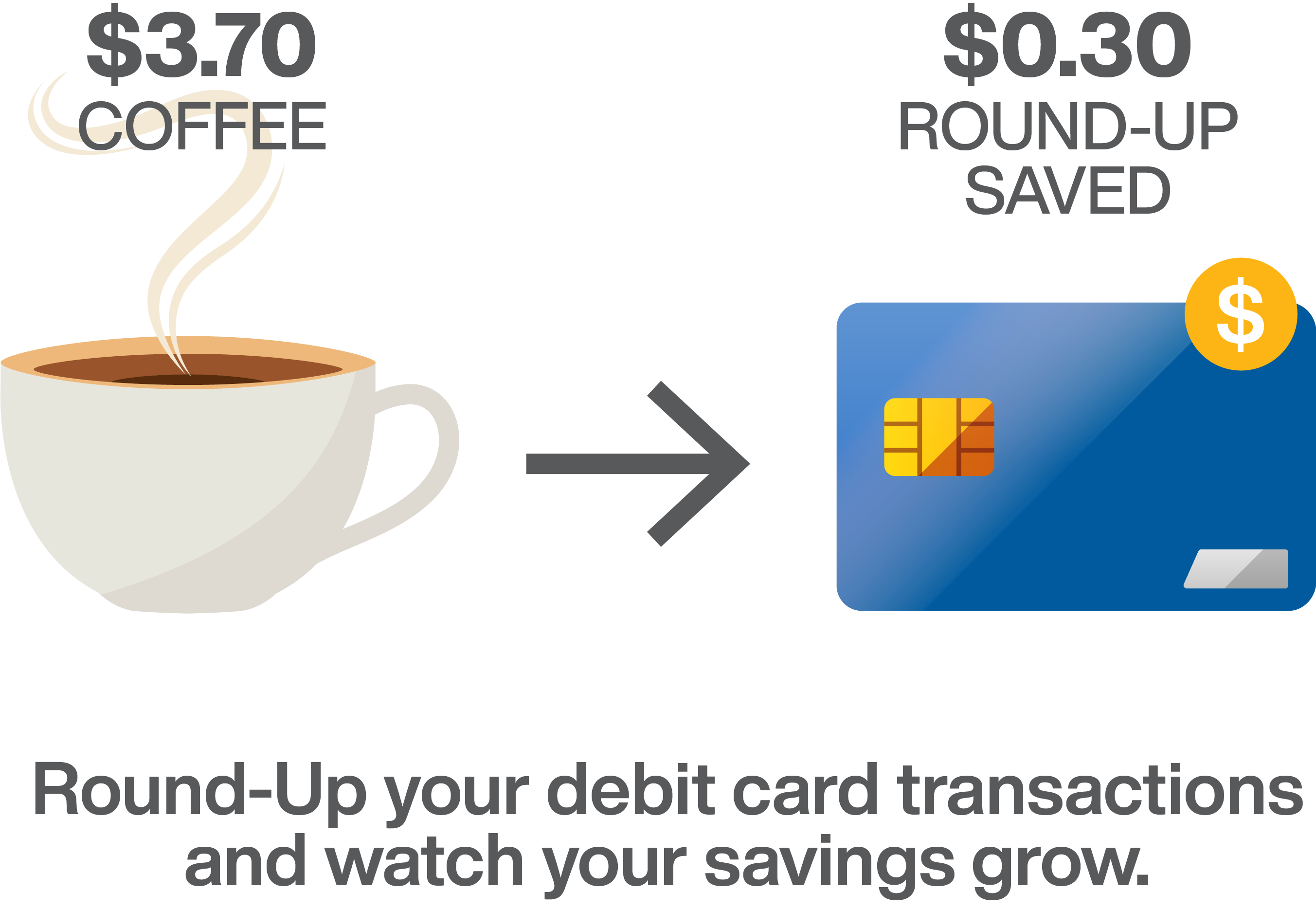

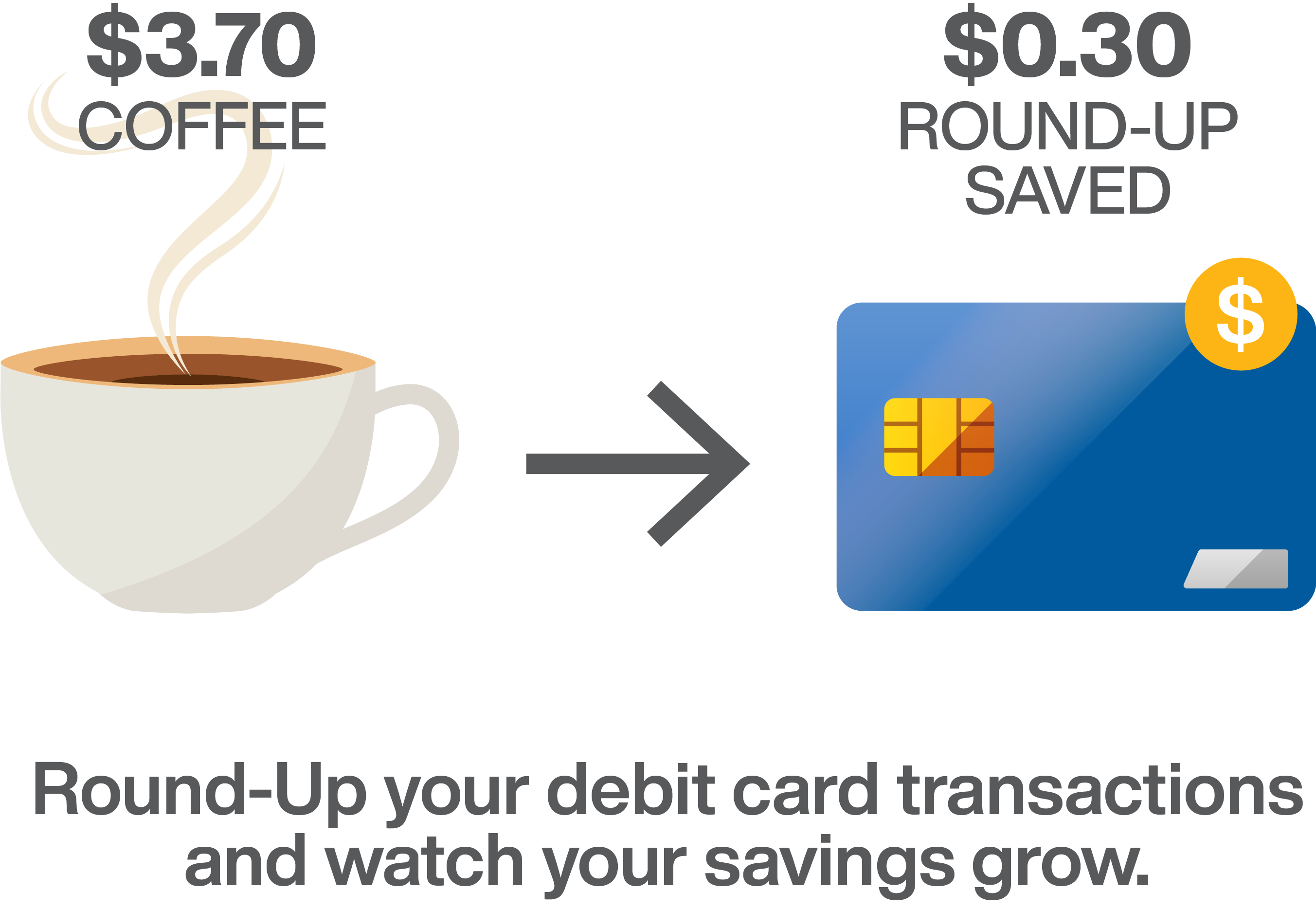

The Grow Your Change savings works together with your Community Financial checking account to help you save automatically. Simply use your Community Financial Debit Card for everyday purchases and we’ll round up the amount of these transactions to the nearest whole dollar and transfer that change from your checking account to your Grow Your Change savings.

Life changes, so we’ve made it easy to manage your savings.

- Pause the round-up, if needed, through online & mobile banking

- Add additional deposits to the account at any time

- Access your funds when needed

Grow Your Change connects easily to your Community Financial checking account.* Start saving today!

*Commercial checking accounts excluded.

The Grow Your Change savings account connects to your Community Financial checking account, excluding commercial checking, to automate your savings. Simply use your Community Financial debit card to make a purchase and the amount of that purchase is rounded up to the nearest whole dollar amount. The round-up amount is then automatically transferred daily from your checking account into your Grow Your Change savings account.

Already have a Community Financial checking account? Simply open a Grow Your Change account and we will connect it to your existing checking account. Once connected, the round-up process will begin when you make your next debit card transaction. If you don’t have an existing Community Financial checking account, open a new checking account with an instant-issue debit card, along with the Grow Your Change account. The round-up process will begin when you make your first debit card purchase transaction.

Yes. All purchases made with your Community Financial debit card are included in the Grow Your Change transfers. You can use your PIN, sign for the purchase, or make an online purchase—all amounts will be rounded up to the next whole dollar amount. ATM transactions are not included in the program. Please note: no round-up transaction will take place if the checking account balance is zero or negative, or will become zero or negative after the round-up transaction.

Each day’s transactions will be combined and one transfer will be made at the end of the business day to move the amount from your checking to Grow Your Change savings. Weekend and holiday processing may vary slightly from this schedule.

Yes, transfers to your Grow Your Change savings account can be paused via our online or mobile banking platforms at any time. You can also call our Member Contact Center at (877) 937-2328 for assistance or visit any branch location.

Purchases made with any debit card associated to your connected Community Financial checking account will be rounded up for the automatic transfer. You are not able to exclude a specific debit card attached to the checking account from the program.

The Grow Your Change savings account must be used. Transfers cannot be made to any other savings accounts.

Refunded, cancelled, or returned debit card transactions do not affect the already transferred round-up amount. The round-up amount from the original debit transaction will remain in your Grow Your Change savings account.

There is no fee when a transfer deposit is made to the account at least once every six (6) months. If you pause/stop transfers for more than six (6) months, a monthly fee will be charged if the average monthly balance in the account is less than $100. Please see our Fee Schedule for more details.

Closing your Grow Your Change savings will stop transfers from your Community Financial checking account. Closing the connected Community Financial checking account does not automatically close your Grow Your Change account. The account will remain open and may be subject to a monthly account fee. Please see our Fee Schedule for more details.

Go to main navigation