Friday, September 16, 2022 You may already know that our Student-Run Credit Union team works tirelessly during the school year to provide exciting and educational opportunities. But did you know that they provide assistance and services during the summer as well? This summer, our Education Partnership Coordinators (EPCs) were hard at work helping the community with fun activities, educational presentations, and more! If you’ve been to a Youth or Kid’s Concert this summer, you’ve probably seen our EPCs in their orange Summer of Sharing T-Shirts, passing out giveaways and spreading the Community Financial spirit to the community. Plymouth’s Music in the Park, Northville Tunes on Tuesday, Canton Tuesdays are Terrific, and Novi Sizzling Summer are just a handful of the great concert partnerships we were fortunate enough to cultivate this year. Our EPCs also had the opportunity to participate in Money Mondays, a summer day camp program through the Plymouth-Canton Community Schools. During Money Mondays, our team members visited Bentley Elementary four times throughout the summer with educational presentations designed to help campers learn financial skills to last a lifetime. Tuesday, August 9, 2022 If you have already borrowed funds from a private lender, you will likely need to start making payments toward your loan before you graduate from your chosen college, university, or trade school. Fortunately, Community Financial and many Federal loan options don’t have this requirement, and alternatively offer in-school deferment options. However, it’s still a good idea to start making headway on any loans as soon as you’re financially able. Here’s all you need to know about managing your student loan debt and transforming something daunting into a breeze: 1. Set It and Forget It The best way to make sure you never miss a payment is to set up an automatic payment plan. With this in mind, it’s always a good idea to check and see if your lender offers discounts for auto-payments. Community Financial, for example, can potentially reduce your rate by 0.25% by enrolling in automatic, electronic payments during repayment from your account. Just make sure your account is ready for the auto-withdrawals so you don’t end up with an overdrawn account! Friday, May 20, 2022 Hillman High School, in Montmorency County, recently teamed up with Community Financial to engage their students in a dose of financial reality! Hillman High School’s eleventh and twelfth grade students participated in a Community Financial sponsored “Reality Fair,” where students were asked to navigate the world of finances as adults! The “Reality Fair,” developed by CUNA (The Credit Union National Association) and used by credit unions around Michigan, is designed to engage students in making money-smart adult choices. Students begin the Reality Fair by receiving a profession with a set salary and credit score. After students are taught about credit card debt, credit scores, student loan payments, and setting a monthly budget, they are tasked with choosing their transportation, housing, child care, home essentials, food, clothing, and more. The goal is for students to build a monthly budget within their set means, while simultaneously learning about the costs of necessary goods and services.

Friday, October 15, 2021 Thursday, October 15, 2020 Community Financial’s Wixom branch opened to members in 2018. Since then, our school partnerships within the Walled Lake Consolidated School District have begun! Wixom Elementary joined in partnership with Community Financial in the fall of 2019. Wixom Elementary’s Student-Run Credit Union volunteers and members demonstrated how to be positive, and have fun, all while learning valuable work skills.

Friday, June 19, 2020 About UsCareersBoard of DirectorsCommunity ImpactADA/ Web Accessibility CloseEnuff™ CheckingSavings AccountsMoney MarketsCertificates of DepositIRAsGrow Your Change Auto LoansBoat & RV LoansPersonal LoansBusiness LoansHome Equity LoansStudent LoansSkip-A-Pay PurchaseRefinanceFirst-Time HomebuyersMortgage Specialists Credit CardsCard Info & DisclosuresFraud Protection Youth ServicesStudent-Run CUGreenlightYoung Adult ServicesScholarshipsCloseEnuff™ Student Checking Community ImpactRelentless Care FoundationChoose The BearBlog Archive

Julie B greets a friend at a Sizzling Summer concert in Novi with plenty of fun things to share!

While it might be tempting to approach student loans the same way you would a venomous spider—that is to say, by not approaching it—that’s not exactly the best tactic. Unfortunately, just like term papers or finals, student loans are a necessity that allow you to continue your higher education when funds are tight.

While it might be tempting to approach student loans the same way you would a venomous spider—that is to say, by not approaching it—that’s not exactly the best tactic. Unfortunately, just like term papers or finals, student loans are a necessity that allow you to continue your higher education when funds are tight.

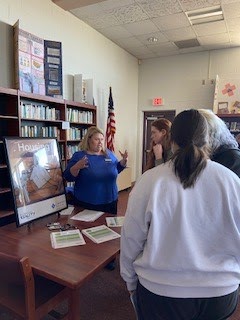

Assistant Manager of the Atlanta Branch, Trena S,

explains the selections on housing and making

good financial choices.

Community Financial’s Education Partnership Coordinators are once again ready and eager to start a new school year filled with financial education and Student-Run Credit Unions! Last year, with many schools going virtual and in-person visits at a minimum, financial education looked a little different (with many presentations done virtually). Nevertheless, lots of learning opportunities took place! We look back on a year of enormous challenges, but with lots of positives and growth in-between with all of our amazing Education Partnership Coordinators, students, and school partnerships!

Two thumbs up for Zombie Math!

Education Partnership Coordinator, Kristen La Forest,

brings financial education to NSH students via the

Student-Run Credit Union program.

P.O. Box 8050

Plymouth, Michigan 48170-8050

(877) 937-2328

2021(61)

December(5)

November(6)

October(5)

September(4)

August(5)

July(3)

June(6)

May(5)

April(5)

March(6)

February(6)

2020(61)

December(6)

All You Need to Know About Going Cashless5 Ways to Trim Your Fixed ExpensesBeware of Debt-Collection ScamsSchool Spotlight: Liberty Middle School and Financial Online Resources for Middle School Students3 Ways to Make Your Holidays Bright (and Safe!)9th Annual Warming Hearts & Homes: You Click, We Donate!

November(5)

October(5)

September(5)

August(4)

July(4)

June(6)

The Complete Guide to Prioritizing Bills During a Financial CrunchAll You Need to Know About Closing CostsSchool Spotlight: New School High Learns Real-Life Skills with the Student-Run Credit Union ProgramCreative Dine-In Cooking: Spaghetti PizzaWhy Is There Still a Shortage on Some Goods?Summer of Sharing 2020: 10 Years of Sharing

May(5)

April(5)

March(6)

February(5)

2019(62)

December(6)

Using 20/20 Vision in Your Financial New Year's ResolutionsStay Safe From These Airbnb Scams This WinterHow to Prepare Your Home for WinterSchool Spotlight: Bentley Elementary Students Benefit with the Student-Run Credit Union and Junior Achievement Programs6 Ways to Keep Your Finances Intact This Holiday SeasonWarming Hearts & Homes is Back. You Click. We Donate!

November(6)

October(6)

Save Money by Dining In | Butternut Squash and Chicken Chili5 Apps to Download Before the Holiday Shopping SeasonSchool Spotlight: Ridge Wood Elementary Teachers Engage Students in Financial EducationInternational Credit Union Day is October 17th!Making Banking Easier with an Updated Mobile App!Ways to Save on Food Costs in College

September(4)

August(4)

July(5)

June(5)

May(5)

April(6)

March(5)

February(5)

2018(63)

December(6)

4 Financial Resolutions for 2019 6 Financial Mistakes People Make in their 20's and How to Fix ThemSchool Spotlight: Local High School Students Learn About CreditMaking the Holidays Count When Home from College7 Naughty Scams to Watch Out for During the HolidaysWarming Hearts & Homes is Back. You Click. We Donate!

November(5)

October(6)

September(4)

August(5)

July(5)

June(5)

May(6)

April(5)

March(5)

February(5)

School Spotlight: Embracing Summer Youth Education

All You Need to Know About Student Loans

A Dose of Reality at Hillman High School

School Spotlight: Looking Back and Moving Forward!

School Spotlight: Staying Positive at Wixom Elementary!

School Spotlight: New School High Learns Real-Life Skills with the Student-Run Credit Union Program

New School High (NSH), a charter high school located in Risen Christ Lutheran Church in Plymouth, is in their fifth year of partnership with our Student-Run Credit Union program. Education Partnership Coordinator, Kristen La Forest, works with teachers to provide financial education to students throughout the school year. Presentation topics include: checking, money management, and credit. Kristen also helps facilitate the Student-Run Credit Union once a month at NSH during lunch.

About Community Financial

Checking & Savings

Business

Investments

Loans

Mortgage Services

Credit Cards

Student Services

eServices

Community

Member Services

Community Financial Credit Union

Visit One of Our 14 Convenient Locations