Tuesday, October 18, 2022 Each year, the Credit Union National Association (CUNA) and the World Council of Credit Unions select a theme for ICU Day. This year’s theme is: “Empower your financial future with a credit union.” At Community Financial, we use International Credit Union Day as an opportunity to celebrate YOU, our members! Visit us in-branch on Thursday, October 20th for more helpful tips to empowering your own financial future. Curious how credit unions are different from big banks? Tuesday, October 11, 2022 Here’s all you need to know about fake lottery scams and how to spot them. How the Scams Play Out In a fake lottery scam, a scammer will reach out to a potential target via phone, email, or through social media platforms to inform them that they’ve won a large amount of cash or major prizes like a new car or other expensive goods. Alternatively, they may offer to let the target play a “free round” of lotto, which will miraculously result in an instant win. To convince the target of their authenticity, the scammer may claim to represent a major lotto company, like Mega Millions, or another recognizable name. In some cases, they’ll pretend to represent a government agency, like the Federal Trade Commission (FTC), or an invented, but real-sounding, program like the “National Sweepstakes Organization”. Tuesday, October 4, 2022 Below, you’ll find our favorite tips and tricks to keep your payments—and your finances in general—safe and secure this October. Always Enroll in Text Alerts At Community Financial, we’re always looking for ways to bolster your financial security while streamlining the process itself. That’s why your Community Financial debit and credit cards are automatically enrolled in Fraud Text Alerts to keep your account safe. If you have cards elsewhere, make sure to inquire about text alerts—making it easy for your financial institution to check in with you about questionable account charges. Go Digital (Securely) Scammers are getting better and better at stealing card information, making the world of payments seem overwhelming and scary. However, you can safeguard your card information by utilizing Community Financial’s digital payment options. Tuesday, September 27, 2022 Here’s what to know about electric cars before you drive off the lot. Pros: The most obvious and prominent advantage of owning an electric vehicle is saving on fuel costs. Driving a car that runs on electricity instead of gasoline means saving money on a large expense category of your budget, month after month. Of course, the higher the cost of gas, the more you save. Right now, with most drivers experiencing pain at the pump, going electric is more popular than ever. Another budgeting bonus to consider is the fact that electricity costs tend to be far more stable than gasoline prices. Tuesday, September 20, 2022 Although lifestyle and personality may influence your choices, there’s a time and place for all modes of payment. We’ve compiled a list of helpful tips that can help you navigate the variety of payment methods and when to use each of them to best utilize benefits. When is Cash King? With the boom of mobile payments, cryptocurrency, and the ever-rising number of person-to-person payment platforms, it may seem logical to think that our society is moving toward becoming cashless. However, cash is still king when it comes to a few different situations. Friday, September 16, 2022 You may already know that our Student-Run Credit Union team works tirelessly during the school year to provide exciting and educational opportunities. But did you know that they provide assistance and services during the summer as well? This summer, our Education Partnership Coordinators (EPCs) were hard at work helping the community with fun activities, educational presentations, and more! If you’ve been to a Youth or Kid’s Concert this summer, you’ve probably seen our EPCs in their orange Summer of Sharing T-Shirts, passing out giveaways and spreading the Community Financial spirit to the community. Plymouth’s Music in the Park, Northville Tunes on Tuesday, Canton Tuesdays are Terrific, and Novi Sizzling Summer are just a handful of the great concert partnerships we were fortunate enough to cultivate this year. Our EPCs also had the opportunity to participate in Money Mondays, a summer day camp program through the Plymouth-Canton Community Schools. During Money Mondays, our team members visited Bentley Elementary four times throughout the summer with educational presentations designed to help campers learn financial skills to last a lifetime. Tuesday, September 13, 2022 If you’re in the market for a new home this fall, keep in mind the following tips and tricks to find your dream home without breaking the bank. Research Childcare Before Bidding For many buyers with young children, childcare expenses and finding the right daycare can not only delay the home-buying process, but also cause undue stress after moving in. Tuesday, September 6, 2022 Join Us for Community Financial’s Annual Shred Day! If you are looking for a way to securely shred and destroy your old documents, bring them to our Shred Day event this September on Saturday the 10th! We will have trucks on site to securely shred documents at 4 of our branch locations this year: Tuesday, August 23, 2022 To safeguard your funds and your peace of mind, Community Financial is here to answer all of your questions about handling cash during times of inflation. Why is it a bad idea to keep cash at home? While it’s perfectly OK to keep some cash at home, storing a large amount of funds in your house has two significant disadvantages: Tuesday, August 16, 2022 Don’t get caught up in a survey scam! Here are eight ways to spot a fake survey and what steps to take if you’ve been tricked: 1. You’re asked to pay to participate in a survey Authentic survey companies need you – you don’t need them. There’s absolutely no reason to pay to take a survey of any kind. If you’re targeted by an ad asking you to take a survey and to pay for the privilege of doing so, don’t respond. 2. You’re asked to share sensitive information before you can take the survey They’d really appreciate it if you could take this quick survey for them. They just need some information from you first, like your Social Security number, date of birth and maybe even your checking account number. If a survey company asks for anything more than basic information from you, sign out as quickly as you can. Tuesday, August 9, 2022 If you have already borrowed funds from a private lender, you will likely need to start making payments toward your loan before you graduate from your chosen college, university, or trade school. Fortunately, Community Financial and many Federal loan options don’t have this requirement, and alternatively offer in-school deferment options. However, it’s still a good idea to start making headway on any loans as soon as you’re financially able. Here’s all you need to know about managing your student loan debt and transforming something daunting into a breeze: 1. Set It and Forget It The best way to make sure you never miss a payment is to set up an automatic payment plan. With this in mind, it’s always a good idea to check and see if your lender offers discounts for auto-payments. Community Financial, for example, can potentially reduce your rate by 0.25% by enrolling in automatic, electronic payments during repayment from your account. Just make sure your account is ready for the auto-withdrawals so you don’t end up with an overdrawn account! Tuesday, August 2, 2022 Mental Wellness: Considering that 1 in 5 adults in the U.S. experience mental illness each year, mental wellness techniques are at the top of the list. While public awareness on this topic has expanded, stigma can still create a barrier to reaching out for help. Let’s work together to break down that barrier and provide helpful tips on mental wellness: Tuesday, July 26, 2022

In 2019, Plymouth residents David and Carly Cirilli started working alongside the City of Plymouth and the Department of Municipal Services to identity open spaces that could be better utilized as gardens for pollinator plants. With restoration in mind, the Cirilli family began creating garden spaces within both city and residential landscapes, educating as they go.

What are Pollinators?

Just a few of the pollinators these amazing gardens provide food and shelter for include bees, butterflies, moths, wasps, beetles, and certain flies—all which do the majority of pollination activities in the wild.

Why are Pollinators Important?

Did you know that over 80% of all flowering plants need assistance from pollinators? In order for flowers to bloom, grow, and return each year, pollination is necessary to complete the reproduction process. In fact, 1 in every 3 bites of food is made possible by pollinators! Tuesday, July 19, 2022 Investing is a great way to grow your funds and secure your financial future. However, choosing your first investments can be tricky. If you are currently employed, you likely already have a retirement plan available through your workplace. There are many ways to maximize this account or even open additional retirement options. Here are some of the most common retirement plans: Tuesday, July 12, 2022 To help get your financial education discussion rolling, we’ve compiled a variety of tips for raising your children to be financially independent. Start with the Basics: Budgeting Successful budgeting is the foundation of every financially independent household. You can introduce your children to the concept of earning money and spending it mindfully when they’re still young, and then build upon that knowledge as they grow older. Tuesday, July 5, 2022

Here’s a run-down of all you need to know about credit cards.

How Credit Cards Work

When you use a credit card to pay for a purchase, you’re borrowing money from the financial institution that issues the credit card. You will be approved for a credit limit that you can charge, that is typically based on credit history, credit score, and relationship. Once approved, each month, you will then be sent a bill to repay the money you’ve borrowed on your credit card. Tuesday, June 28, 2022

Below, we’ve compiled 10 financial steps to take after a divorce that can help set you up for success.

1. Close all joint accounts If you haven’t already taken this step, do so immediately. Review all your financial accounts and credit cards and close all the ones that are jointly owned by you and your ex-spouse. In the best-case scenario, failure to take this step can leave your accounts open to fines and maintenance charges for accounts you don’t really use. Tuesday, June 21, 2022 Unfortunately, too many people end up buying out each workday because they don’t realize how much it costs them, or they simply fail to plan ahead. Others may think it would be too much of a hassle to shop for, prep, and bring along lunch from home. Here are some hacks for brown-bagging it to work with all the savings and none of the hassle. Friday, June 17, 2022 Supporting Our Partnering School Districts Community Financial believes strongly in supporting school districts with the funding that they may need. Donations are made annually to educational foundations (when applicable) in our partnering school districts. Wixom Elementary is part of the Walled Lake Consolidated School District (WLCSD), and therefore, donations have been made since 2018 to their foundation, the Foundation for Excellence. Tuesday, June 14, 2022

How the scams play out There are several variations of job scams. Here are the most common ones: Tuesday, June 7, 2022

1. Contact Your Financial Institution Give us a call at (877) 937-2328 before you set off on your vacation. By notifying your financial institution of your vacation plans, they’ll know to honor any card transactions you make when abroad or in a different state. If you’re planning to go overseas for your vacation, be sure to check in to any foreign transaction fees and map out your plan early so you know the best ATMs to utilize to avoid extra fees. Wednesday, June 1, 2022 Nominations begin today, June 1st. Starting today, you are invited to visit SummerOfSharing.org to submit an essay-style nomination explaining how your favorite nonprofit helps the community it serves. These nominations will stay live on the site for others to learn about how each of the organizations are making a difference. Tuesday, May 31, 2022 Maintain High Standards In the workplace, good enough is never truly good enough. Keep your standards high and aim for excellence in every project you work on, or task you complete. Review your official job expectations often to see if you measure up and keep yourself in the loop of the company’s evolving goals and vision. To help yourself along this course, check in with your manager often for progress reports and to see what, if anything, you might be able to do better. Tuesday, May 24, 2022 If you have retirement on the horizon, you’ve probably been doing a lot of planning. Topics such as health care, designating a power of attorney, and IRA withdrawals are all top-of-mind for retirees. But have you thought about your financial planning as it pertains to your mortgage? Refinancing before retirement can be an advantageous choice for many—but is it the right choice for you? To figure out if this is the right option for you and your financial needs, be sure to consider the situation from all angles. First Thing’s First. Money.

Refinancing doesn’t come cheap. It’s only worth the cost if you come out ahead in the end. To start your financial journey, make sure to crunch the numbers carefully before making your decision to move forward with a refinance. To verify how a refinance will impact your bottom line, use our Mortgage Refinance Calculator to sort through a variety of factors (for example, your interest rate, closing costs, and how long you plan on staying in your current home) and see how your new payment would change. Friday, May 20, 2022 Hillman High School, in Montmorency County, recently teamed up with Community Financial to engage their students in a dose of financial reality! Hillman High School’s eleventh and twelfth grade students participated in a Community Financial sponsored “Reality Fair,” where students were asked to navigate the world of finances as adults! The “Reality Fair,” developed by CUNA (The Credit Union National Association) and used by credit unions around Michigan, is designed to engage students in making money-smart adult choices. Students begin the Reality Fair by receiving a profession with a set salary and credit score. After students are taught about credit card debt, credit scores, student loan payments, and setting a monthly budget, they are tasked with choosing their transportation, housing, child care, home essentials, food, clothing, and more. The goal is for students to build a monthly budget within their set means, while simultaneously learning about the costs of necessary goods and services.

Tuesday, May 17, 2022 Scammers never take a break from dreaming up new ways to con people out of their money. Recently, they’ve even been hijacking QR codes to pull scams on innocent victims. Here’s all you need to know about QR code scams and how to avoid them. What’s a QR code? Before we can explore the details of these scams, let’s understand what a QR code is and how one works. A QR code, which is an acronym for “Quick Response code,” is a square barcode that can be scanned using a smartphone and leads directly to a website or app. Businesses use QR codes for any number of reasons, from posting online menus, to scanning coupons, to processing payments, and more. Tuesday, May 10, 2022 When it comes to the process of purchasing your first home, excitement and nerves are completely normal. However, the challenges of being a first-time homeowner can feel intimidating—daunting, even—particularly for those moving on their own for the first time. Let’s take a look at a few guidelines and tips that can help take the stress out of the decision to purchase your first home. Your First Home Isn’t Usually Your Forever Home When it comes to the purchase of a new home as a real estate investment, many first-time home buyers tend to want the biggest house they can get. With thoughts of starting families or getting enough space for an existing family to grow, buying a house is one of the first times people tend to really plan out their lives 30 years in advance. Tuesday, May 3, 2022 Talking finances with your partner may not be your idea of a shared romantic moment, but communicating openly about how you manage your money is a crucial part of having an honest and trusting relationship. It’s fairly common knowledge that arguing about money is one of the leading cause of divorce in the U.S., and no one wants to be the next statistic. To avoid defensive behavior or friction, we’ve compiled a list of ways for you and your partner to have a comprehensive, yet productive, discussion about money.

Tuesday, April 26, 2022 With inflation driving up costs on pretty much everything imaginable, monthly budgets have really taken a hit. With higher costs come increased stress as households struggle to rebalance their budgets and reassess what costs are truly necessary each month. And while we all need to stay entertained in our free-time, recreation and entertainment is usually the first item to go when it comes to cutting costs. However, there are plenty of ways to trim your entertainment budget that don’t include fully cutting it out! Below, we’ve listed eight of our favorite ways to save on entertainment costs and get your budget back on track.

Friday, April 22, 2022 We’ve all heard about the benefits of recycling. It’s good for the environment, it helps to reuse plastics that don’t naturally decompose on their own, and it makes us feel good. But how much do you really know about the practice itself? This Earth day, take the opportunity to brush up on good recycling habits to help the planet. We’ve compiled our favorite recycling tips and tricks below.

Best Plastic Practices We’ve all heard that plastic products are some of the worst things to happen to our planet. But did you know why? While products made of wood, cardboard, or paper can decompose in landfills over time or be reused for other projects, that’s not really the case with plastic products. A plastic shopping bag, for example, can take up to 20 years to break down, while a plastic water bottle can take up to 450 years or more! Tuesday, April 19, 2022 High debt can be a beast, taking huge bites out of a household budget and destroying any chance of financial wellness. To make matters worse, being in high debt can mean being stuck in a desperate cycle that never ends, as payback is often accompanied by high interest rates that make it hard to get ahead. Unfortunately, scammers know this well, so they target victims with debt relief scams to get at their money. Here’s what you need to know about debt relief scams and how to avoid them. Friday, April 15, 2022 Students at Starkweather Academy are preparing for life outside of the classroom. Starkweather Academy provides an alternative/adult education program within the Plymouth-Canton Community School District. Students at Starkweather have the opportunity to complete their high school education with smaller class sizes, acquire “English as a Second Language” help if needed, or get support in preparing for the GED exam. In addition to Starkweather’s focused curriculum, Community Financial offers many financial education presentations to help students with their finances. Education Partnership Coordinator, Kristen L., is frequently at Starkweather Academy preparing students for their financial future. She leads engaging presentations on budgeting skills, credit, investing, car buying, fraud, and interviewing skills. She also conducts “Food and Finance” trivia, where students answer financial education questions during their lunch for prizes.

Tuesday, April 12, 2022 Did you know that April is Financial Literacy Month? While it’s a good idea to keep your financial education up to date all year long, now is the perfect time to take a step back and reassess your finances and the techniques you use to stay financially literate. Whether you’re looking to brush up on your own knowledge, or learn tips for teaching money-smart choices to your children, there’s always something new to learn. Below, you will find a handful of our favorite financial resources to help build your knowledge during this year’s Financial Literacy Month! Tuesday, April 5, 2022 As we continue into 2022, many of us here at Community Financial have already started our New Year’s Resolutions. As you may know, the majority of resolutions have already been discarded by this time of year. However, sticking to your goals of healthy eating, exercise, and mindfulness can be so much easier when you share the practice with others! Courtesy of Community Financial’s Innovation Committee, a group made up of team members across all departments, we are happy to share our New Year, New You Recipes and Connections initiative! Throughout March and April, our team members have been collaborating to keep our bodies and minds working at full speed. Below, we’ve compiled a list of the top comments, recipes, and more so you too can practice healthy habits this spring. Tuesday, March 29, 2022 Did you know that March is National Credit Education Month? If not, don’t worry! The world of credit can be incredibly confusing, but we’re here to help make it easier to navigate. We’ve compiled the best tips to not only obtain your score safely, but also build or repair your credit, no matter where you’re starting from. First thing’s first: What is a credit score? A credit score is a numerical expression that indicates a person’s credit worthiness, or ability to pay back loans on time. The higher the score, the more likely you’ll be able to obtain a loan with favorable terms, such as a low interest rate, which means you will end up paying less interest on your loans in the long-run. Credit scores can vary from 0 to 850. For those without any current or previous loans, your credit score would be non-existent. Tuesday, March 22, 2022

Everyone loves payday, but too many people struggle with allocating their paycheck in a way that best serves their financial needs. If you’re looking for a little extra guidance in utilizing your income effectively, we’ve compiled a list of tips below that will help you do just that! Friday, March 18, 2022 Happy March is Reading Month! Community Financial’s Education Partnership Coordinators participate in many “March is Reading Month” activities in our partnering schools, and are very busy reading to students this month! Financial education is represented in several fun and engaging books for students of all ages. Fourth grade students at Edison Elementary in Westland, for example, recently listened to Education Partnership Coordinator (EPC), Michelle R., read “Joe the Monkey Saves for a Goal.” With this book, and many others in the Money Mammals series, students can learn about saving their money at an early age in a fun and engaging way. Tuesday, March 15, 2022 Each January, millions of people select their New Year’s resolutions, such as spending less, paying down debt, and focusing on physical health. Now that we’re in March, many of those same goals may be moving to the back-burner. Without the glitz and glam of New Year’s in the rearview mirror, you may be wondering how to stick to your financial goals this Spring. In order to build financial habits that last, it’s important to create an effective foundation. Below, we’ve compiled a list of tips that can help you keep those resolutions, while creating health savings and credit habits that will last a lifetime. Tuesday, March 8, 2022 In an increasingly-digital world, people use devices and technology for all sorts of things. Shopping, social media, finances, vacation planning, and everything in between. While increased accessibility to these outlets helps make things in our lives quick and convenient, having so much personal information online leaves us vulnerable to cyber criminals looking to make a quick buck. Data breaches alone have exposed hundreds of millions of consumers to hackers, with almost 1.4 million complaints of identity theft in 2020 alone, according to the Federal Trade Commission (FTC). That’s more than $3.3 billion stolen by identity thieves in one year! Tuesday, March 1, 2022 We often give a “thumbs up” to things we like such as Facebook statuses and Netflix shows. During the month of March, Community Financial is making it easy for you to give a “thumbs up” to your favorite charity with our 9th annual “Thumbs Up for Charity!” program! So how can you get involved? Starting Monday, March 7th, you can nominate a local organization that's doing great work in your community for a chance to receive a donation up to $10,000! Nominations will be accepted at cfcu.org/thumbsup until Friday, March 25, 2022. Tuesday, February 22, 2022 With the semiconductor chip shortage and inflation driving up prices of new and used cars, the process of getting a new set of wheels right now may seem overwhelming. Finding a new car that meets your criteria is challenging in today’s market, and with the prices of leases rising, with limited availability among many models, you may be wondering what the best choice really is. Should you buy a new car or lease from a dealership? To help you get the most bang for your buck, let’s take a deeper look into the advantages and drawbacks of buying/leasing your next vehicle in 2022. Friday, February 18, 2022 Miller Elementary, in Canton, celebrates ten years of partnership with Community Financial! For the past ten years, Miller Elementary students have been saving their money and learning the business of banking at the Student-Run Credit Union. Students at Miller Elementary have definitely acquired some valuable work and financial skills during our dedicated, decade-long journey together! Tuesday, February 15, 2022 Ready to start saving money by making more meals at home? We’re here with our favorite tips and tricks to get your kitchen into gear so you can start saving on food costs today! Tuesday, February 8, 2022 Here at Community Financial, we take our members’ safety very seriously. We use multiple protective measures to keep you, your information and your money safe when you use one of our ATMs. However, it’s important for you, as the member, to be aware of basic ATM safety so your transactions are never compromised. As with all banking platforms, you are the first and best defense for protecting your personal information and your money. Here are 10 tips to help you keep your ATM transactions completely secure. Tuesday, February 1, 2022 Robocalls have got to be one the most annoying inventions of the 21st century. Unfortunately, those phone calls can do a lot more than disrupt your dinner to send you running to the phone just to hear about an offer for an extended warranty on your car. Using sophisticated spoofing methods and dogged persistence, they can swindle unsuspecting targets out of hundreds, or even thousands of dollars, using nothing but a phone. In fact, according to data from Trucaller, Americans lost close to $30 billion to phone scams in 2020. Technology has made it far too easy and cheap for scammers to place a huge number of robocalls in seconds. New robocall platforms can make up to 5,000 simultaneous calls a second for as little as a dollar. Even if only 10 of these phone calls have their desired effect on the targets, the scammers have pulled in a solid profit. Here’s what you need to know about phone scams and how to avoid them.

Tuesday, January 25, 2022 In our digital world, passwords are as much a part of our lives as Netflix and Amazon. Keeping information stored in dozens of accounts across the web can make it easier to stay on top of your finances, order a new pair of jeans, or even schedule a dentist appointment. Unfortunately, passwords can be relatively easy for scammers to hack, opening the door for identity theft, credit card fraud, and more. Here’s where multifactor authentication (MFA) comes into play. As a means of securing your information, MFA provides an extra layer of protection for your accounts and sensitive data. Here’s all you need to know about MFA, how it works, and why it’s an important step in protecting your information.

Friday, January 21, 2022 This year our Education Partnership Coordinators had to get creative! The goal was, and continues to be, ensuring that our youngest Community Financial Credit Union members stay safe while being able to reach their savings goals. Through-out the pandemic thus far, there have been a number of methods developed to enable students to make deposits at their schools. Some students even got to enjoy the experience of working the Student-Run Credit Unions while keeping socially distant!

Tuesday, January 18, 2022 Inflation isn’t going anywhere soon The rising prices currently happening in just about every sector is hardly surprising news at this point. The inflation rate fell at the start of the coronavirus pandemic as the nationwide lockdown had people hunkering down in their homes. In March 2021 however, the impact of halted manufacturing began hitting the market and crude oil prices started climbing, and the inflation rate increased to 2.6%, hitting its current high of 5.4% in June and July. While the rate started falling in August to 5.3%, it then climbed right back up to 6.2% in October. Unfortunately, for the average consumer who’s struggling to cover expenses amid rising costs, this means inflation isn’t going anywhere soon.

Tuesday, January 11, 2022 With January comes the second half of the school year and, for upperclassmen, the impending excitement (and dread) of college right around the corner. While there are many amazing things to look forward to when graduating high school, the looming worry about college tuition is there for the majority of graduates. If you’re part of the nearly 60% of Americans worried about having enough money to pay for college or trade school, you’re not alone. And while it may seem daunting—we’re here to help! Focus on Positives

Tuesday, January 4, 2022 With the new year comes New Year’s resolutions and the chance to start anew. And while many resolutions may revolve around personal goals, like living a healthier lifestyle or reading more books, business resolutions are just as important! The new year is the perfect time to reinvent your business and breathe new life into your finances. So, let’s put on our entrepreneurial hats together and get ready for 5 exciting ways to jumpstart your small business resolutions. Set an Exciting Goal

Blog Archive

International Credit Union (ICU) Day® has been celebrated on the third Thursday of October since 1948. It’s a day recognizing and celebrating the impactful history of the credit union movement and its unique spirit and philosophy. This year, ICU Day is October 20th!

International Credit Union (ICU) Day® has been celebrated on the third Thursday of October since 1948. It’s a day recognizing and celebrating the impactful history of the credit union movement and its unique spirit and philosophy. This year, ICU Day is October 20th! Continuing our education this Cybersecurity Month, there’s a new scam to look out for! While everyone dreams of winning the lottery, scammers are patiently waiting in the wings to turn that dream into a nightmare. A fake lottery scam involves one or more scammers pretending to be a legitimate lottery company in order to con their unsuspecting victims out of their information and hard-earned money.

Continuing our education this Cybersecurity Month, there’s a new scam to look out for! While everyone dreams of winning the lottery, scammers are patiently waiting in the wings to turn that dream into a nightmare. A fake lottery scam involves one or more scammers pretending to be a legitimate lottery company in order to con their unsuspecting victims out of their information and hard-earned money. With the continued onslaught of fraudsters and identity thieves hiding behind every corner of the internet, Cybersecurity Month is the perfect time to reassess your financial security and make sure everything is in tip-top shape. Securing your payments is one such activity you can do this month to help fight off future scam artists.

With the continued onslaught of fraudsters and identity thieves hiding behind every corner of the internet, Cybersecurity Month is the perfect time to reassess your financial security and make sure everything is in tip-top shape. Securing your payments is one such activity you can do this month to help fight off future scam artists. With gas prices soaring, thousands of drivers are beginning to consider the purchase of an electric car. While an electric vehicle (EV) might be the right choice for many when looking to combat rising gas prices and help preserve natural resources, there are lots of variables to consider before taking the plunge.

With gas prices soaring, thousands of drivers are beginning to consider the purchase of an electric car. While an electric vehicle (EV) might be the right choice for many when looking to combat rising gas prices and help preserve natural resources, there are lots of variables to consider before taking the plunge. With inflation soaring and financial security a constant topic of conversation, it’s fair to say that wanting to spend money in the most effective way possible is at the front of many of our minds. But what does that mean? Is it better to pay for everyday purchases with cash, credit, or debit?

With inflation soaring and financial security a constant topic of conversation, it’s fair to say that wanting to spend money in the most effective way possible is at the front of many of our minds. But what does that mean? Is it better to pay for everyday purchases with cash, credit, or debit?

Julie B greets a friend at a Sizzling Summer concert in Novi with plenty of fun things to share!

Finding and closing on a home is a stressful process. From bidding wars to a lack of suitable properties, many hurdles can await hopeful homeowners. But when it comes to finding a new home during the back-to-school season, especially when you have kids 18 or younger in the family, it can add on additional stresses. In fact, according to the National Association of Realtors, 55% of buyers with children 18 or younger in the home believe the most difficult step is finding the right property because of the need for a neighborhood with convenient and quality schools nearby.

Finding and closing on a home is a stressful process. From bidding wars to a lack of suitable properties, many hurdles can await hopeful homeowners. But when it comes to finding a new home during the back-to-school season, especially when you have kids 18 or younger in the family, it can add on additional stresses. In fact, according to the National Association of Realtors, 55% of buyers with children 18 or younger in the home believe the most difficult step is finding the right property because of the need for a neighborhood with convenient and quality schools nearby. Identity thieves and scammers can use credit cards, financial statements, or utility bills, or other important paperwork to obtain and exploit your personal information. Your first line of defense to keep this theft from happening in the first place is to destroy documents containing your personal information before anyone can access them. Private documents and credit/debit cards, which contain sensitive information, should be destroyed as soon as you no longer need them.

Identity thieves and scammers can use credit cards, financial statements, or utility bills, or other important paperwork to obtain and exploit your personal information. Your first line of defense to keep this theft from happening in the first place is to destroy documents containing your personal information before anyone can access them. Private documents and credit/debit cards, which contain sensitive information, should be destroyed as soon as you no longer need them. We’ve all heard of a family member or friend who swears keeping cash at home is safer than in a bank or credit union, especially during times of inflation. While it may be tempting to hide away your nest egg in your sock drawer or stuffed under the mattress, keeping large amounts of money at home is one of the riskiest ways to keep your cash.

We’ve all heard of a family member or friend who swears keeping cash at home is safer than in a bank or credit union, especially during times of inflation. While it may be tempting to hide away your nest egg in your sock drawer or stuffed under the mattress, keeping large amounts of money at home is one of the riskiest ways to keep your cash.

Survey scams are almost as old as the internet. They’re so prevalent that you can hardly spend an hour online without running into an ad for a “super quick” survey promising a reward for just a few minutes of your time. What actually happens, though, is that the scammer walks away with a free survey, or worse, your information and/or your money. While an alert consumer can spot a survey scam easily, fraudsters are becoming more sophisticated at making them look legitimate.

Survey scams are almost as old as the internet. They’re so prevalent that you can hardly spend an hour online without running into an ad for a “super quick” survey promising a reward for just a few minutes of your time. What actually happens, though, is that the scammer walks away with a free survey, or worse, your information and/or your money. While an alert consumer can spot a survey scam easily, fraudsters are becoming more sophisticated at making them look legitimate. While it might be tempting to approach student loans the same way you would a venomous spider—that is to say, by not approaching it—that’s not exactly the best tactic. Unfortunately, just like term papers or finals, student loans are a necessity that allow you to continue your higher education when funds are tight.

While it might be tempting to approach student loans the same way you would a venomous spider—that is to say, by not approaching it—that’s not exactly the best tactic. Unfortunately, just like term papers or finals, student loans are a necessity that allow you to continue your higher education when funds are tight. Wellness comes in many forms: physical, mental, emotional, financial, and more. Staying on the top of your wellness game may seem like an easy task, but it’s one that requires dedication and persistence. We’ve compiled some of our favorite wellness activities below to help jumpstart your journey.

Wellness comes in many forms: physical, mental, emotional, financial, and more. Staying on the top of your wellness game may seem like an easy task, but it’s one that requires dedication and persistence. We’ve compiled some of our favorite wellness activities below to help jumpstart your journey.

In our 12th year of Summer of Sharing, Community Financial is fortunate enough to donate $60,000 in total to 60 local charitable organizations, community programs, and educational funds in Michigan. One such organization, who was selected as a Summer of Sharing recipient at the beginning of June 2022, is the Plymouth Pollinators.

In our 12th year of Summer of Sharing, Community Financial is fortunate enough to donate $60,000 in total to 60 local charitable organizations, community programs, and educational funds in Michigan. One such organization, who was selected as a Summer of Sharing recipient at the beginning of June 2022, is the Plymouth Pollinators.  Retirement looks different for everyone. Whether that includes lounging on a beach reading your favorite books, having the flexibility to volunteer your time, or just plain enjoying your post-career life. Regardless of your retirement goals however, one thing remains the same. Planning for retirement is a process that takes years and should be started as early as possible—ideally, at the beginning of your working career. Below, you’ll find our top tips on how to start planning early so you can retire when and how you’ve always dreamed.

Retirement looks different for everyone. Whether that includes lounging on a beach reading your favorite books, having the flexibility to volunteer your time, or just plain enjoying your post-career life. Regardless of your retirement goals however, one thing remains the same. Planning for retirement is a process that takes years and should be started as early as possible—ideally, at the beginning of your working career. Below, you’ll find our top tips on how to start planning early so you can retire when and how you’ve always dreamed. Raising children in today’s society has a variety of challenges, but none so timeless as the need to teach one’s children about finances. Financial education is a topic often missed in traditional schooling, leaving parents and loved ones to teach healthy financial habits on their own. While it may seem overwhelming to do so, raising financially independent children will help smooth the transition into adulthood, giving them the tools needed to achieve and maintain financial wellness throughout their entire lives.

Raising children in today’s society has a variety of challenges, but none so timeless as the need to teach one’s children about finances. Financial education is a topic often missed in traditional schooling, leaving parents and loved ones to teach healthy financial habits on their own. While it may seem overwhelming to do so, raising financially independent children will help smooth the transition into adulthood, giving them the tools needed to achieve and maintain financial wellness throughout their entire lives. As the world continues to trend toward cashless transactions, credit cards have become a household necessity. Managing a credit card responsibly is crucial to establishing credit history, which directly impacts your approval and interest rate for future lending, understanding credit cards—and how to use them!—is a must.

As the world continues to trend toward cashless transactions, credit cards have become a household necessity. Managing a credit card responsibly is crucial to establishing credit history, which directly impacts your approval and interest rate for future lending, understanding credit cards—and how to use them!—is a must.  When it comes to going through a divorce, one of the biggest stressors is identifying how to deal with finances moving forward and working through possible financial strain. Making sense of finances after divorce takes work and time, but with proper planning and a responsible approach, it’s completely doable!

When it comes to going through a divorce, one of the biggest stressors is identifying how to deal with finances moving forward and working through possible financial strain. Making sense of finances after divorce takes work and time, but with proper planning and a responsible approach, it’s completely doable!  Did you know that choosing to bring your own lunch to work each day can save up to $3,000 a year? Each takeout lunch can easily cost $12 more than a homemade meal. If you’d put that money into an index fund and contribute to it for 25 years, you could end up saving close to $500,000!

Did you know that choosing to bring your own lunch to work each day can save up to $3,000 a year? Each takeout lunch can easily cost $12 more than a homemade meal. If you’d put that money into an index fund and contribute to it for 25 years, you could end up saving close to $500,000!

It’s an amazing employment opportunity – or is it? Scammers often hijack the job market and ensnare hopeful job seekers into their schemes. If you’re job-hunting, it’s a good idea to review the way these scams play out and how you can avoid them. To help you out, we’ve put together a short primer on what you need to know to stay safe from job scams.

It’s an amazing employment opportunity – or is it? Scammers often hijack the job market and ensnare hopeful job seekers into their schemes. If you’re job-hunting, it’s a good idea to review the way these scams play out and how you can avoid them. To help you out, we’ve put together a short primer on what you need to know to stay safe from job scams.

Your bags are packed, your itinerary is set, and you’re counting down the minutes until you take off for your dream summer getaway. Before you head out to the airport or get in your car for a road trip, though, read through this checklist of important things people tend to forget before leaving for vacation.

Your bags are packed, your itinerary is set, and you’re counting down the minutes until you take off for your dream summer getaway. Before you head out to the airport or get in your car for a road trip, though, read through this checklist of important things people tend to forget before leaving for vacation.

When it comes to your career, it’s important to plan and think about ways to reach your goals. Whether that be a great promotion, heading up a favorite project, or furthering your education, making yourself indispensable at work can help you reach all of these goals and more! To make yourself indispensable at work, follow the tips below:

When it comes to your career, it’s important to plan and think about ways to reach your goals. Whether that be a great promotion, heading up a favorite project, or furthering your education, making yourself indispensable at work can help you reach all of these goals and more! To make yourself indispensable at work, follow the tips below:

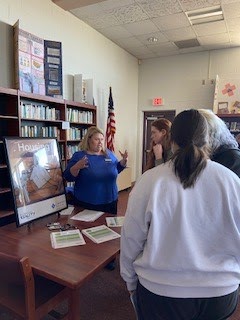

Assistant Manager of the Atlanta Branch, Trena S,

explains the selections on housing and making

good financial choices.

Coordinator Kristen L. shares her

knowledge about credit and credit scores

with a class at Starkweather.

Mrs. Mueller's 4th grade

class at Edison Elementary

listen to EPC Michelle R. read

"Joe the Monkey Saves for a Goal."

Miller and the Student-Run Credit

Union have been together since 2012! Whether it’s the hassle of prepping meals or the exhaustion from work at the end of the day, there are plenty of reasons people turn to take-out and delivery. In fact, restaurant spend has been at an all-time high recently, with many households spending almost $9,000 annually on food purchases.

Whether it’s the hassle of prepping meals or the exhaustion from work at the end of the day, there are plenty of reasons people turn to take-out and delivery. In fact, restaurant spend has been at an all-time high recently, with many households spending almost $9,000 annually on food purchases. With 86% of the American population utilizing ATMs each year, it’s more important than ever to brush up on ATM safety. Unfortunately, scammers are everywhere—and using a compromised machine can mean risking identity theft and/or having cash stolen.

With 86% of the American population utilizing ATMs each year, it’s more important than ever to brush up on ATM safety. Unfortunately, scammers are everywhere—and using a compromised machine can mean risking identity theft and/or having cash stolen.

Coordinator Amy P. and D-Pozit making

the rounds on PCSA Wagon Deposit Days!

Go to main content

Go to main content

About Us | Locations & Hours | Contact Us | Careers | Press Room | Loan Payment Center | Routing: 272483743|

2021(61)

December(5)

November(6)

October(5)

September(4)

August(5)

July(3)

June(6)

May(5)

April(5)

March(6)

February(6)

2020(61)

December(6)

All You Need to Know About Going Cashless5 Ways to Trim Your Fixed ExpensesBeware of Debt-Collection ScamsSchool Spotlight: Liberty Middle School and Financial Online Resources for Middle School Students3 Ways to Make Your Holidays Bright (and Safe!)9th Annual Warming Hearts & Homes: You Click, We Donate!

November(5)

October(5)

September(5)

August(4)

July(4)

June(6)

The Complete Guide to Prioritizing Bills During a Financial CrunchAll You Need to Know About Closing CostsSchool Spotlight: New School High Learns Real-Life Skills with the Student-Run Credit Union ProgramCreative Dine-In Cooking: Spaghetti PizzaWhy Is There Still a Shortage on Some Goods?Summer of Sharing 2020: 10 Years of Sharing

May(5)

April(5)

March(6)

February(5)

2019(62)

December(6)

Using 20/20 Vision in Your Financial New Year's ResolutionsStay Safe From These Airbnb Scams This WinterHow to Prepare Your Home for WinterSchool Spotlight: Bentley Elementary Students Benefit with the Student-Run Credit Union and Junior Achievement Programs6 Ways to Keep Your Finances Intact This Holiday SeasonWarming Hearts & Homes is Back. You Click. We Donate!

November(6)

October(6)

Save Money by Dining In | Butternut Squash and Chicken Chili5 Apps to Download Before the Holiday Shopping SeasonSchool Spotlight: Ridge Wood Elementary Teachers Engage Students in Financial EducationInternational Credit Union Day is October 17th!Making Banking Easier with an Updated Mobile App!Ways to Save on Food Costs in College

September(4)

August(4)

July(5)

June(5)

May(5)

April(6)

March(5)

February(5)

2018(63)

December(6)

4 Financial Resolutions for 2019 6 Financial Mistakes People Make in their 20's and How to Fix ThemSchool Spotlight: Local High School Students Learn About CreditMaking the Holidays Count When Home from College7 Naughty Scams to Watch Out for During the HolidaysWarming Hearts & Homes is Back. You Click. We Donate!

November(5)

October(6)

September(4)

August(5)

July(5)

June(5)

May(6)

April(5)

March(5)

February(5)

October 20th is International Credit Union Day!

Don’t Get Caught in a Fake Lottery Scam

Cybersecurity Month: Secure Your Payments

Should Your Next Car be Electric?

Finding the Best Way to Pay: Cash, Credit, or Debit

School Spotlight: Embracing Summer Youth Education

Finding a Home During the Back-to-School Season

Protect Your Information at Our Upcoming Shred Day!

Should I Keep Cash at Home?

How to Spot a Survey Scam

All You Need to Know About Student Loans

August is Wellness Month

Summer of Sharing Spotlight: Plymouth Pollinators

How to Start Retirement Planning Early

Raising Financially Independent Children

Beginner’s Guide to Credit Cards

Tips for Divorcees: Rebuilding Your Finances

Save Big Bucks by Brown-Bagging Your Lunch

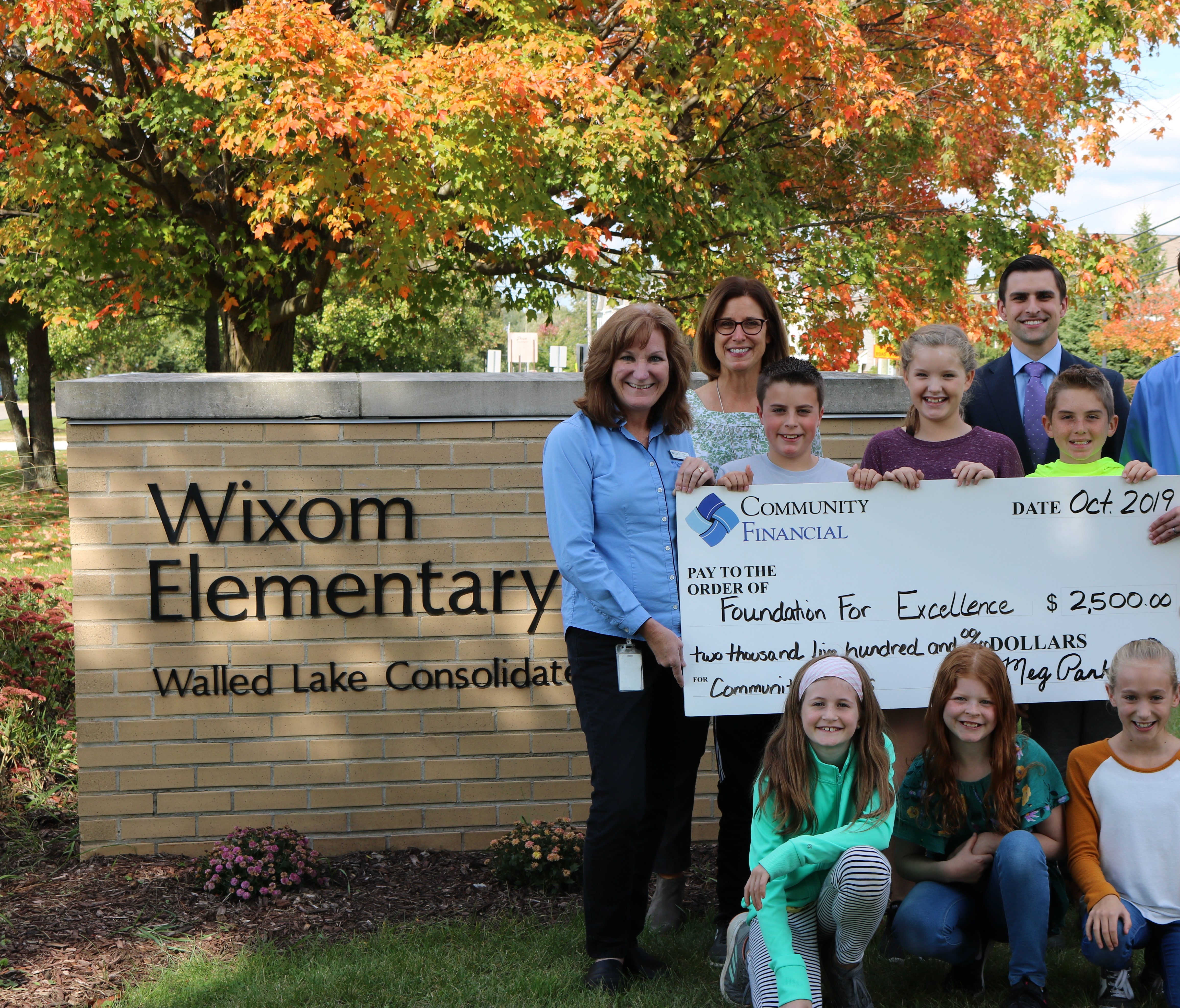

Wixom Elementary and the Foundation for Excellence

Beware of Job Scams

Tips for Summer Travel

Summer of Sharing is Back!

How to Make Yourself Indispensable at Work

Retirement Tips: Is Refinancing Worth It?

A Dose of Reality at Hillman High School

Don't Get Caught in a QR Code Scam

Steps to Buying Your First Home

How to Talk Finances with your Partner

How to Save on Entertainment Costs

Good Recycling Habits for Earth Day

Beware of Debt Relief Scams

School Spotlight: Starkweather Academy Students Prepare for their Future

Financial Literacy Month Resources

Get Cooking with Community Financial

National Credit Education Month: Raise Your Score!

The Best Way to Spend Your Paycheck

School Spotlight: “March is Reading Month” at Edison Elementary

Building Financial Habits that Last

How to Protect Against Identity Theft

Thumbs Up for Charity is Back!

Is Buying or Leasing Your Best Bet?

School Spotlight: Miller Elementary Celebrates 10 Years of Partnership!

Get Your Kitchen into Gear and Start Saving

10 Tips for ATM Safety

Scam Alert: Phone Call Scams Could Cost You

Security Tips: Multi-Factor Authentication

School Spotlight: Safe Savers for the 2021-2022 School Year

Is Inflation Here to Stay in 2022?

With the recent hike in prices, it may feel like you need to take out a second mortgage just to fill up on gas and restock the pantry. Why is this and are these inflated prices here to stay? Well, according to a recent Bureau of Labor Statistics report, U.S. inflation is currently running at a 13-year high at 6.2% as of October 2021--and it’s showing no signs of slowing down anytime soon. Here’s what you need to know about the current state of the U.S. economy and what you can likely expect in the coming months.

Tips for Grads: Planning for College Tuition

Jumpstart Your Small Business Resolutions

About Community Financial

About UsCareersBoard of DirectorsCommunity ImpactADA/ Web Accessibility

Checking & Savings

CloseEnuff™ CheckingSavings AccountsMoney MarketsCertificates of DepositIRAsGrow Your Change

Business

Investments

Loans

Auto LoansBoat & RV LoansPersonal LoansBusiness LoansHome Equity LoansStudent LoansSkip-A-Pay

Mortgage Services

PurchaseRefinanceFirst-Time HomebuyersMortgage Specialists

Credit Cards

Credit CardsCard Info & DisclosuresFraud Protection

Student Services

Youth ServicesStudent-Run CUGreenlightYoung Adult ServicesScholarshipsCloseEnuff™ Student Checking

eServices

Community

Community ImpactRelentless Care FoundationChoose The Bear

Member Services

Community Financial Credit Union

P.O. Box 8050

Plymouth, Michigan 48170-8050

(877) 937-2328

Visit One of Our 14 Convenient Locations