Tuesday, May 31, 2022 Maintain High Standards In the workplace, good enough is never truly good enough. Keep your standards high and aim for excellence in every project you work on, or task you complete. Review your official job expectations often to see if you measure up and keep yourself in the loop of the company’s evolving goals and vision. To help yourself along this course, check in with your manager often for progress reports and to see what, if anything, you might be able to do better. Tuesday, May 24, 2022 If you have retirement on the horizon, you’ve probably been doing a lot of planning. Topics such as health care, designating a power of attorney, and IRA withdrawals are all top-of-mind for retirees. But have you thought about your financial planning as it pertains to your mortgage? Refinancing before retirement can be an advantageous choice for many—but is it the right choice for you? To figure out if this is the right option for you and your financial needs, be sure to consider the situation from all angles. First Thing’s First. Money.

Refinancing doesn’t come cheap. It’s only worth the cost if you come out ahead in the end. To start your financial journey, make sure to crunch the numbers carefully before making your decision to move forward with a refinance. To verify how a refinance will impact your bottom line, use our Mortgage Refinance Calculator to sort through a variety of factors (for example, your interest rate, closing costs, and how long you plan on staying in your current home) and see how your new payment would change. Friday, May 20, 2022 Hillman High School, in Montmorency County, recently teamed up with Community Financial to engage their students in a dose of financial reality! Hillman High School’s eleventh and twelfth grade students participated in a Community Financial sponsored “Reality Fair,” where students were asked to navigate the world of finances as adults! The “Reality Fair,” developed by CUNA (The Credit Union National Association) and used by credit unions around Michigan, is designed to engage students in making money-smart adult choices. Students begin the Reality Fair by receiving a profession with a set salary and credit score. After students are taught about credit card debt, credit scores, student loan payments, and setting a monthly budget, they are tasked with choosing their transportation, housing, child care, home essentials, food, clothing, and more. The goal is for students to build a monthly budget within their set means, while simultaneously learning about the costs of necessary goods and services.

Tuesday, May 17, 2022 Scammers never take a break from dreaming up new ways to con people out of their money. Recently, they’ve even been hijacking QR codes to pull scams on innocent victims. Here’s all you need to know about QR code scams and how to avoid them. What’s a QR code? Before we can explore the details of these scams, let’s understand what a QR code is and how one works. A QR code, which is an acronym for “Quick Response code,” is a square barcode that can be scanned using a smartphone and leads directly to a website or app. Businesses use QR codes for any number of reasons, from posting online menus, to scanning coupons, to processing payments, and more. Tuesday, May 10, 2022 When it comes to the process of purchasing your first home, excitement and nerves are completely normal. However, the challenges of being a first-time homeowner can feel intimidating—daunting, even—particularly for those moving on their own for the first time. Let’s take a look at a few guidelines and tips that can help take the stress out of the decision to purchase your first home. Your First Home Isn’t Usually Your Forever Home When it comes to the purchase of a new home as a real estate investment, many first-time home buyers tend to want the biggest house they can get. With thoughts of starting families or getting enough space for an existing family to grow, buying a house is one of the first times people tend to really plan out their lives 30 years in advance. Tuesday, May 3, 2022 Talking finances with your partner may not be your idea of a shared romantic moment, but communicating openly about how you manage your money is a crucial part of having an honest and trusting relationship. It’s fairly common knowledge that arguing about money is one of the leading cause of divorce in the U.S., and no one wants to be the next statistic. To avoid defensive behavior or friction, we’ve compiled a list of ways for you and your partner to have a comprehensive, yet productive, discussion about money.

Blog Archive

When it comes to your career, it’s important to plan and think about ways to reach your goals. Whether that be a great promotion, heading up a favorite project, or furthering your education, making yourself indispensable at work can help you reach all of these goals and more! To make yourself indispensable at work, follow the tips below:

When it comes to your career, it’s important to plan and think about ways to reach your goals. Whether that be a great promotion, heading up a favorite project, or furthering your education, making yourself indispensable at work can help you reach all of these goals and more! To make yourself indispensable at work, follow the tips below:

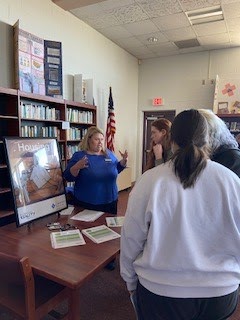

Assistant Manager of the Atlanta Branch, Trena S,

explains the selections on housing and making

good financial choices.

Go to main content

Go to main content

About Us | Locations & Hours | Contact Us | Careers | Press Room | Loan Payment Center | Routing: 272483743|

2021(61)

December(5)

November(6)

October(5)

September(4)

August(5)

July(3)

June(6)

May(5)

April(5)

March(6)

February(6)

2020(61)

December(6)

All You Need to Know About Going Cashless5 Ways to Trim Your Fixed ExpensesBeware of Debt-Collection ScamsSchool Spotlight: Liberty Middle School and Financial Online Resources for Middle School Students3 Ways to Make Your Holidays Bright (and Safe!)9th Annual Warming Hearts & Homes: You Click, We Donate!

November(5)

October(5)

September(5)

August(4)

July(4)

June(6)

The Complete Guide to Prioritizing Bills During a Financial CrunchAll You Need to Know About Closing CostsSchool Spotlight: New School High Learns Real-Life Skills with the Student-Run Credit Union ProgramCreative Dine-In Cooking: Spaghetti PizzaWhy Is There Still a Shortage on Some Goods?Summer of Sharing 2020: 10 Years of Sharing

May(5)

April(5)

March(6)

February(5)

2019(62)

December(6)

Using 20/20 Vision in Your Financial New Year's ResolutionsStay Safe From These Airbnb Scams This WinterHow to Prepare Your Home for WinterSchool Spotlight: Bentley Elementary Students Benefit with the Student-Run Credit Union and Junior Achievement Programs6 Ways to Keep Your Finances Intact This Holiday SeasonWarming Hearts & Homes is Back. You Click. We Donate!

November(6)

October(6)

Save Money by Dining In | Butternut Squash and Chicken Chili5 Apps to Download Before the Holiday Shopping SeasonSchool Spotlight: Ridge Wood Elementary Teachers Engage Students in Financial EducationInternational Credit Union Day is October 17th!Making Banking Easier with an Updated Mobile App!Ways to Save on Food Costs in College

September(4)

August(4)

July(5)

June(5)

May(5)

April(6)

March(5)

February(5)

2018(63)

December(6)

4 Financial Resolutions for 2019 6 Financial Mistakes People Make in their 20's and How to Fix ThemSchool Spotlight: Local High School Students Learn About CreditMaking the Holidays Count When Home from College7 Naughty Scams to Watch Out for During the HolidaysWarming Hearts & Homes is Back. You Click. We Donate!

November(5)

October(6)

September(4)

August(5)

July(5)

June(5)

May(6)

April(5)

March(5)

February(5)

How to Make Yourself Indispensable at Work

Retirement Tips: Is Refinancing Worth It?

A Dose of Reality at Hillman High School

Don't Get Caught in a QR Code Scam

Steps to Buying Your First Home

How to Talk Finances with your Partner

About Community Financial

About UsCareersBoard of DirectorsCommunity ImpactADA/ Web Accessibility

Checking & Savings

CloseEnuff™ CheckingSavings AccountsMoney MarketsCertificates of DepositIRAsGrow Your Change

Business

Investments

Loans

Auto LoansBoat & RV LoansPersonal LoansBusiness LoansHome Equity LoansStudent LoansSkip-A-Pay

Mortgage Services

PurchaseRefinanceFirst-Time HomebuyersMortgage Specialists

Credit Cards

Credit CardsCard Info & DisclosuresFraud Protection

Student Services

Youth ServicesStudent-Run CUGreenlightYoung Adult ServicesScholarshipsCloseEnuff™ Student Checking

eServices

Community

Community ImpactRelentless Care FoundationChoose The Bear

Member Services

Community Financial Credit Union

P.O. Box 8050

Plymouth, Michigan 48170-8050

(877) 937-2328

Visit One of Our 14 Convenient Locations