Friday, May 20, 2022 Hillman High School, in Montmorency County, recently teamed up with Community Financial to engage their students in a dose of financial reality! Hillman High School’s eleventh and twelfth grade students participated in a Community Financial sponsored “Reality Fair,” where students were asked to navigate the world of finances as adults! The “Reality Fair,” developed by CUNA (The Credit Union National Association) and used by credit unions around Michigan, is designed to engage students in making money-smart adult choices. Students begin the Reality Fair by receiving a profession with a set salary and credit score. After students are taught about credit card debt, credit scores, student loan payments, and setting a monthly budget, they are tasked with choosing their transportation, housing, child care, home essentials, food, clothing, and more. The goal is for students to build a monthly budget within their set means, while simultaneously learning about the costs of necessary goods and services.

Friday, January 18, 2019 Friday, November 16, 2018 Friday, July 20, 2018 Friday, June 15, 2018 Friday, May 18, 2018 About UsCareersBoard of DirectorsCommunity ImpactADA/ Web Accessibility CloseEnuff™ CheckingSavings AccountsMoney MarketsCertificates of DepositIRAsGrow Your Change Auto LoansBoat & RV LoansPersonal LoansBusiness LoansHome Equity LoansStudent LoansSkip-A-Pay PurchaseRefinanceFirst-Time HomebuyersMortgage Specialists Credit CardsCard Info & DisclosuresFraud Protection Youth ServicesStudent-Run CUGreenlightYoung Adult ServicesScholarshipsCloseEnuff™ Student Checking Community ImpactRelentless Care FoundationChoose The BearBlog Archive

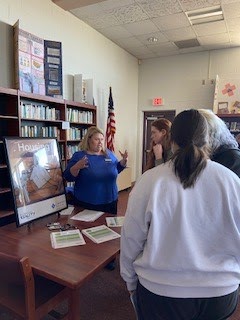

Assistant Manager of the Atlanta Branch, Trena S,

explains the selections on housing and making

good financial choices.

For the responsible adult who thinks about being prepared for the future, savings are a fixed expense that is built into the monthly budget just like car payments and insurance. For most people, though, this habit does not come naturally. Community Financial is helping students in our northern communities develop these savings habits from an early age.

Gaylord Student-Run Credit Union winter volunteers.

In our Northern communities, our school partners include: Gaylord Intermediate School, Lewiston Elementary, Atlanta Community and Hillman Elementary School. Gaylord Intermediate School has been a partner with us since 2004. Here are this winter's 6th grade Student-Run Credit Union volunteers from Gaylord Intermediate School!

Community Financial is excited for our first year in partnership with Grand River Academy in Livonia! Partnering with Grand River Academy marked Community Financial’s 50th Student-Run Credit Union! Our Student-Run Credit Union program provides students with a fun way to learn real-life skills. Each student who would like to volunteer to work at the Student-Run Credit Union will go through an interviewing process similar to what adults experience. Grand River Academy’s fifth and seventh grade students recently learned how the interviewing process works.

Education Partnership Coordinator, Amy Pashukewich,

instructs potential student hires on how to conduct

themselves in an interview setting.

Our Education Partnership Coordinators first teach students the importance of filling out an application in their best handwriting, dressing well for an interview, smiling and making eye contact. First impressions are incredibly important, and students are given the opportunity to practice these skills at a young age! Here are Grand River Academy’s very first potential “hires!”

???

Kristen La Forest, our high school Education Partnership Coordinator, created a “Senior Checklist” for 12th grade Advanced Marketing students this past school year at the Plymouth-Canton Educational Park. She interacted with these students as they ran our credit unions at P-CEP. This checklist ensured students were financially ready for the world of credit cards, credit scores, savings and checking accounts.

Kristen La Forest, our high school Education Partnership Coordinator, created a “Senior Checklist” for 12th grade Advanced Marketing students this past school year at the Plymouth-Canton Educational Park. She interacted with these students as they ran our credit unions at P-CEP. This checklist ensured students were financially ready for the world of credit cards, credit scores, savings and checking accounts.

High School Partnerships Lead Teens to Financial Success and Away From Fraud!

High School Partnerships Lead Teens to Financial Success and Away From Fraud!

Community Financial has exceptional partnerships with high schools in the Plymouth-Canton area. We are partners with P-CEP, Starkweather Academy, Canton Preparatory High School, and New School High. We have also conducted presentations at Northville High School and Clarenceville High School.

Education Partnership Coordinator, Kristen La Forest, runs our high school partnerships and prepares high school students for financial success. Mrs. La Forest creates and gives presentations to high school students on topics such as fraud, credit, credit scores, checking accounts, interviewing techniques, financial aid, etc. She is a wonderful resource for high school students just beginning to explore and navigate the financial world! Here are some pictures of Mrs. La Forest presenting the topic “Teens and Fraud” to students at Starkweather High School.

Education Partnership Coordinator, Angela Corbin,

posing with her Lewiston Elementary Spring Volunteers.Student-Run Credit Unions in the North!

Community Financial has school partnerships in five schools near our northern branches. Students in Gaylord Intermediate, Lewiston Elementary, Atlanta, Gaylord St. Mary’s, and Hillman Intermediate schools participate in our Student-Run Credit Union program.

Our Education Partnership Coordinator, Angela Corbin, works with schools in these areas to help educate the youth in northern Michigan. Here are some pictures of Angela with her student volunteers at Lewiston Elementary School!

P.O. Box 8050

Plymouth, Michigan 48170-8050

(877) 937-2328

2021(61)

December(5)

November(6)

October(5)

September(4)

August(5)

July(3)

June(6)

May(5)

April(5)

March(6)

February(6)

2020(61)

December(6)

All You Need to Know About Going Cashless5 Ways to Trim Your Fixed ExpensesBeware of Debt-Collection ScamsSchool Spotlight: Liberty Middle School and Financial Online Resources for Middle School Students3 Ways to Make Your Holidays Bright (and Safe!)9th Annual Warming Hearts & Homes: You Click, We Donate!

November(5)

October(5)

September(5)

August(4)

July(4)

June(6)

The Complete Guide to Prioritizing Bills During a Financial CrunchAll You Need to Know About Closing CostsSchool Spotlight: New School High Learns Real-Life Skills with the Student-Run Credit Union ProgramCreative Dine-In Cooking: Spaghetti PizzaWhy Is There Still a Shortage on Some Goods?Summer of Sharing 2020: 10 Years of Sharing

May(5)

April(5)

March(6)

February(5)

2019(62)

December(6)

Using 20/20 Vision in Your Financial New Year's ResolutionsStay Safe From These Airbnb Scams This WinterHow to Prepare Your Home for WinterSchool Spotlight: Bentley Elementary Students Benefit with the Student-Run Credit Union and Junior Achievement Programs6 Ways to Keep Your Finances Intact This Holiday SeasonWarming Hearts & Homes is Back. You Click. We Donate!

November(6)

October(6)

Save Money by Dining In | Butternut Squash and Chicken Chili5 Apps to Download Before the Holiday Shopping SeasonSchool Spotlight: Ridge Wood Elementary Teachers Engage Students in Financial EducationInternational Credit Union Day is October 17th!Making Banking Easier with an Updated Mobile App!Ways to Save on Food Costs in College

September(4)

August(4)

July(5)

June(5)

May(5)

April(6)

March(5)

February(5)

2018(63)

December(6)

4 Financial Resolutions for 2019 6 Financial Mistakes People Make in their 20's and How to Fix ThemSchool Spotlight: Local High School Students Learn About CreditMaking the Holidays Count When Home from College7 Naughty Scams to Watch Out for During the HolidaysWarming Hearts & Homes is Back. You Click. We Donate!

November(5)

October(6)

September(4)

August(5)

July(5)

June(5)

May(6)

April(5)

March(5)

February(5)

A Dose of Reality at Hillman High School

School Spotlight: Gaylord Intermediate Students Set Savings Goals

School Spotlight: Grand River Academy Students Learn Interviewing Skills

School Spotlight: P-CEP Seniors Get Financially Ready for Real World

Go to main navigation

Go to main navigation

Fast Exit

The Senior Checklist

Mrs. La Forest asked questions like “What are the five factors that determine a person’s credit score?” and “What is the difference between using the credit option on a debit card vs. using a ‘real’ credit card?” Here are some pictures of Mrs. La Forest and two of her students in May with their completed “Senior Checklist!”

School Spotlight: Local High Schools Learn About Fraud

School Spotlight in the North: Students Take the $5 Bill Quiz

About Community Financial

Checking & Savings

Business

Investments

Loans

Mortgage Services

Credit Cards

Student Services

eServices

Community

Member Services

Community Financial Credit Union

Visit One of Our 14 Convenient Locations